b&o tax credit

Small Business BO Tax Credit. The credit was so high cost in part because the credit was non.

Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization.

. The tax incentive provides a 2000 credit against the businesses B. Additionally the Legislature has specially created. Demande de Crédit100 en Ligne.

The cost per job-year created is estimated to be between 40000 and 50000. Businesses must also file an. Make a pledge of as little as 1000 to Puyallup Main Street Association beginning January 14 2019 pay the pledge to PMSA by November 15th and 75 of your pledge will be deducted from your.

Or a credit of 4000 for each new employment position with wages and benefits of. Demande de Crédit100 en Ligne. The BO taxis 02 two tenths of one percent on businesses with annual gross receipts of more than 250000.

Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community. The Rural County Business and Occupation BO Tax Credit for New Employees provides a credit against the BO tax for each new employment position illed and maintained by qualiied businesses located in a rural county or Community Empowerment Zone CEZ. The following requirements must be met in order to take this BO tax credit.

Businesses providing accommodations medical or food services are exempt. Members of Wheeling City Council now will vote in early February on a one-time BO Tax credit program for small businesses that was approved by the citys Finance Committee early this evening. If you owe beneath a certain level you pay zero tax.

Taux les Plus Bas. Taux les Plus Bas. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution you have made to the Alliance on your.

The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. Syrup must be used by the buyer in making carbonated drinks. This credit is commonly referred to as the small business BO tax credit or small business credit SBC.

The Program Provides 2000 credit for each new qualiied. The credit equals 20 percent of the wages and benefits a business pays to or on behalf of a qualified employee up to a maximum of 1500 for each. BO Tax Credit for Syrup Tax Paid Credit ID 945 A retailing business that pays syrup tax when buying carbonated beverage syrup to make carbonated fountain drinks can claim a BO tax credit as of July 1 2006.

To document the credit the Customized Training Credit Worksheet must be completed and submitted with the return. The Main Street Tax Credit Incentive Program provides a Business Occupation BO tax credit for private contributions given to your local Main Street organization the Downtown Waterfront Alliance. Beginning October 1 2016 businesses that hire unemployed veterans may qualify for credit against their State business and occupation BO tax or public utility tax PUT.

The Small Business BO Tax Credit is applied on a sliding scale that depends upon the amount of tax you owe. As your company becomes more profitable the scale slides upward. The tax credit may not exceed the BO tax amount due.

Tax credits for the B O tax can be due to a taxpayer who overpaid hisher taxes for the prior fiscal year. The MVDA shares our thanks to BO Tax Credit Supporters Perry Carlson and Windermere Skagit Valley. Direct your tax dollars back into your community.

BO Tax Credit Program. Ad Prêt en Moins de 24h - Crédit Consommation. We correct for the endogeneity of RD tax credits received by individual firms by using instrumental variables based in part on national industry factor shares for RD.

Ad Prêt en Moins de 24h - Crédit Consommation. New BO Tax Credit. Trina Perry has been an MVDA Board Member since 2018 and Perry Carlson became BO Tax Incentive Partners this year for 2019.

The Washington State Department of Revenue Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to Main Street Coupeville Historic Waterfront Association. The amount of small business BO tax credit available on a tax return can increase or decrease depending on the reporting frequency of the account and the. The credit is itemized on the Credits section of the excise tax return.

Distributors are allowed a refund processed through of the Business and Occupation taxes paid by a distributor whose volume of business activities is. This allows smaller companies with lower income levels to pay a much smaller percentage of their profits to the Department of Revenue. This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451.

Electronic filing of all returns documents and surveys is required. The proposal would allow small businesses with fewer than 25 employees to forgo payment for the first quarter of 2021 if the business owners are current with their BOO taxes. Credits may be carried over until July 1 2021.

See more result. New businesses or startups that bring 25 or more full-time jobs into the city would qualify for a taxcredit over three consecutive years. We estimate that this tax credit created jobs but at a high cost.

The credit increases each year.

Projects Programs Kent Downtown Partnership

B O Tax Credit Program Puyallup Main Street Association

Main Street Tax Credit Program In Washington

Historic Tax Credit City Of Grafton Wv

Baltimore And Ohio Railroad Museum Baltimore And Ohio Railroad Museum Ohio

B Amp O Tax City Of Bellingham

Business And Occupation B O Tax Washington State And City Of Bellingham

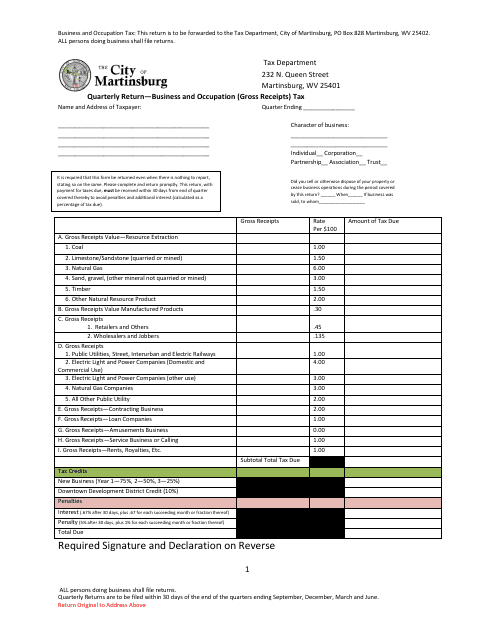

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

B O Tax Credit Program Sumner Main Street Association